Better Regulations Are Required for Africa’s Growing Crypto Market. New demands for more consumer protection and regulation of the cryptocurrency business have been made in response to the failure of FTX, the third-largest cryptocurrency exchange in the world, and the consequent decline in the prices of Bitcoin, Ethereum, and other important crypto assets.

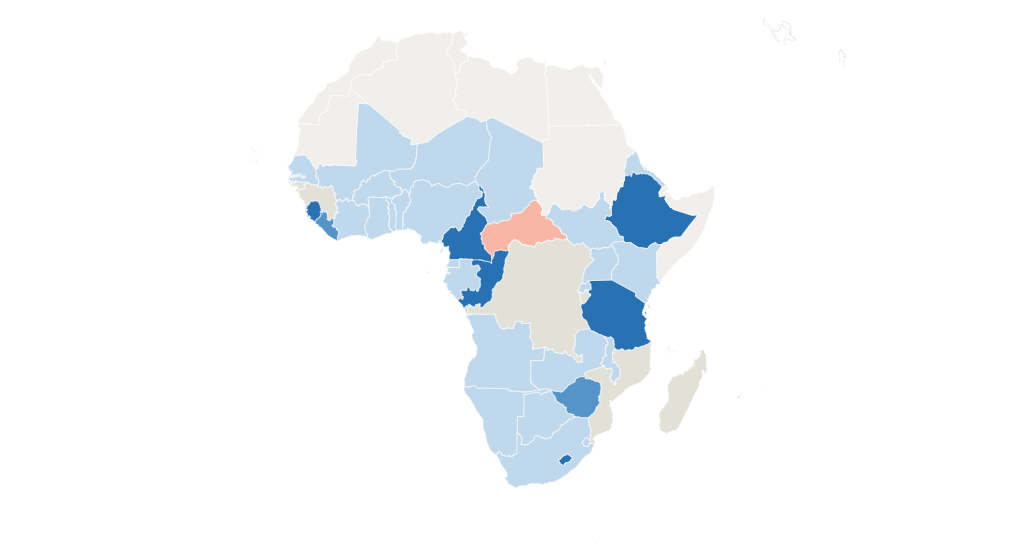

Most governments still struggle to regulate a highly unpredictable, decentralized economy since doing so requires striking a balance between reducing risk and fostering innovation. Only 25% of sub-Saharan African nations have established cryptocurrency regulations. However, as our Chart of the Week demonstrates, two-thirds have put in place some restrictions, and six nations—the Republic of Congo, Cameroon, Ethiopia, Lesotho, Sierra Leone, Tanzania—have outlawed cryptocurrency. All banks in Zimbabwe have been ordered to stop processing transactions, and a local cryptocurrency business in Liberia has been told to stop operating (implicit bans).

Ban on cryptocurrency

About 20% of the sub-Saharan African nations have outlawed digital currency.

According to Chainalysis, the crypto market in Africa is among the largest and fastest-growing in the world, with a peak in monthly transactions of $20 billion expected in the middle of 2021. The most users in the region are in Kenya, Nigeria, and South Africa. Although many people utilize crypto assets for business transactions, their volatility prevents them from being useful as a store of value.

Politicians are also concerned that cryptocurrencies could be used to evade regional regulations intended to stop capital outflows and transfer money illegally out of the area. The widespread usage of cryptocurrencies might also undermine the efficiency of monetary policy, endangering the stability of the financial system and the macroeconomy.

If cryptocurrency is accepted as legal tender, as the Central African Republic just did, the hazards will be significantly increased. Public finances may be at danger if the government decides to hold or accept cryptocurrency as payment.

After El Salvador, the Central African Republic is the second nation in the world to recognize Bitcoin as legal cash. It is also the first in Africa. The move breaches the CEMAC Treaty and has caused conflict with the Bank of Central African States (BEAC), the central bank for the Economic and Monetary Community of Central Africa (CEMAC), of which the Central African Republic is a member. The Central African Banking Commission, BEAC’s regulatory authority for the banking industry, has outlawed the usage of cryptocurrencies in financial transactions.